The following is intended for adult audiences only. The following is intended for adult audiences only. The following is intended for adult audiences only. The following is intended for adult audiences only. The following is intended for adult audiences only. The following is intended for adult audiences only. The following is intended for adult audiences only.

Above all else, Celestia aims to be credibly neutral. Tendermint consensus, data availability sampling (DAS), and a few other pieces work together to offer rollups a premium data layer, while state minimization on the L1 ensures teams and environments don’t compete directly with Celestia while also minimizing MEV (maximal extractable value) issues on the base layer.

To be credibly neutral, Celestia must exist. Sustainability long-term has many meanings, but for blockchains it boils down to limiting state growth and having a viable security (read: token) model. Celestia solves for the former, but arguably lacks the latter.

Economics and utility

While some of this section may seem a bit pedantic or academic, for a chain to exist in perpetuity it needs viable economics. To see what happens without them, simply refer to the hundreds of PoS networks with little economic value or security in the depths of Coingecko.

The Principal and Agent of a blockchain

Abstractly, the community can be seen as a principal wanting some specific protocol to be run on their behalf. Stakers act as agents on their behalf, running this protocol. In return for doing so, stakers earn inflation (and fees). To be eligible as agents, stakers buy something, either energy and hardware (PoW) or tokens and hardware (PoS).

From the start, this means agents have a cost from staking or mining. Unless they are ideologically/speculatively long, they will sell off rewards to recoup initial capital. And since staking is not a recurring cost, agents can consistently sell without losing agency. For users, the incentive is to own the token that gives them maximum utility with as low dilution as possible. This creates a dilemma - how can the principal balance user demand (stable purchasing power) against a recurring need for security? How can it ensure incentives don’t eat security?

Regression Theorem of Value

Ludwig Von Mises’ Regression of Theorem of Value - popular in Bitcoin forums early on - suggests a currency’s value today is derived from yesterday’s value. Value can then be regressed back to a time when it was solely a consumable commodity. Based on one commodity’s properties - its scarcity, its portability, etc - it was adopted as a means of exchange before becoming a general medium exchange acceptable for most goods and services.

For today’s networks, the more things purchasable internal and external to the blockspace, the closer the commodity is to being a general medium of exchange. Under this lens, the choice long-term is binary: move towards being a more general medium and compete on yield, liquidity, decentralization, etc or keep the asset as a consumable commodity tied to one network.

The cost of sybil resistance

Every chain progresses via a base rate inflationary block subsidy. This inflation can be realized or sold against users, but if it is realized at too high a rate, then the network will struggle to get persistent user demand. E.g., too high inflation makes things poor stores of value.

If inflation is not offset by constant new demand entering or activity causing a burn of supply, then the total security of the PoS network will slowly bleed out. The rewards driving consensus will be worth less and the network (if it is PoS) will be cheaper to attack as it ages. Eventually, stakers may even sell their principal balance and abandon the network. Low inflation can slow this drawdown, but any rewards not offset will harm security long-term.

To offset this inflation the network needs uses for its token, likely beyond one or just a few things. This is especially true in a world of fee compression (e.g., scaling).

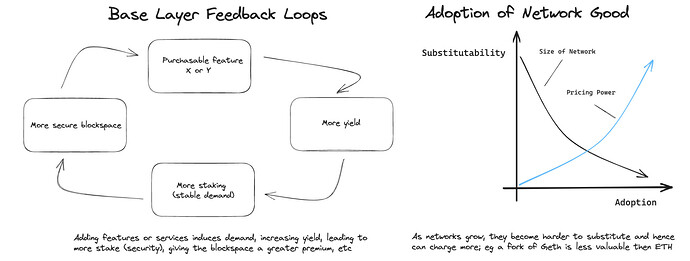

Positive feedback loops

I won’t spend time on these, as they are pretty self-evident, but they are useful to keep in mind.

Drilling into application-specific designs

Use token X or use token Y

Imagine you are going onto an exchange or payments app as an (aspiring) first time crypto user. You are greeted with a host of tokens and unsure of which one to buy, you stumble through your contacts to your one college “buddy” who got you to buy Namecoin in 2013.

Eager to buy an NFT after chatting with your buddy, you purchase SOL because you hear it’s fast and has good ones. Naturally, you don’t think about it too much, but from the protocol’s standpoint you’ve contributed to temporary demand (and possibly stable demand).

From every other network’s perspective, they lost out on new demand, fees, and the increased liquidity and other things a marginal user brings. While it doesn’t matter for every network today too much what happens at the margin, on a long enough horizon this demand encourages every network to offer the same utility and applications.

Demand drivers

Every base layer today has different demand drivers. Polynya has an excellent post on the demand drivers for ETH. Essentially it boils down to:

- Economic collateral 2. Staking 3. Reserve asset (e.g., for MEV searcher) 4. Medium of exchange

- Unit-of-account 6. Speculation and 7. Transaction fee burns

When compared with Polkadot - which consists of parachains renting security from a generic Relay chain which coordinates DOT staking - ETH has a lot of uses. ETH is a more general medium than DOT and that generality feeds into itself, creating a more stable asset.

While DOT has more than one use case - it can be used for messaging, for renting a parachain slot, and for staking (14% yield anyone?) - it is not a gas token. This means it isn’t used by MEV searchers in reserves, revenue from temporary spikes in demand don’t pass to nodes, and it’s only usable as collateral once bridged, introducing trust assumptions and clunkiness.

A lack of utility has resulted in more cyclical behavior for DOT, as demand for it is almost entirely speculation, not utility. Its lack of a native execution environment has made BSC and Osmosis its most liquid venues, meaning fees from trading go to them, not Polkadot or parachains.

Is X-specific or X-service enough?

Every app-specific chain (not app-specific rollups), posits it can provide some utility or service and receive enough demand for that service to (on average) outpace inflation. In principal-agent terms, every app-specific chain believes recurring demand for the feature it provides.

For these networks, sustainability can be achieved long-term if the network holds this inequality:

Demand for service (paid in kind) ≥ sybil resistance costs (inflation)

Notably, these chains have to discount staking rates by the opportunity cost of capital, which today is the risk-free rate or funding rate (or yield from staking on another network).

Under this model, app-specific chains look like a wacky internet bond: yield is realizable inflation + the fees/MEV earned from service providing. The demand to stake long-term will correlate with the volatility of the asset (FX risk), slashing risk (smallish) and yield (fees + realizable inflation). Said differently, staking demand will fluctuate mostly based on demand for the service.

Naturally, these chains face competition from general-purpose chains + centralized providers. Generalized chains amortize sybil resistance costs across many apps, while centralized ones (e.g., data availability committee ~DAC) don’t have sybil costs. If the service is commoditized and makes chains compete on being the lowest most efficient producer, then inflation will have to be lowered as fees are lowered. Notably, cheaper nodes enables lowering inflation.

Celestia Today

For any app-specific blockchain, funding sybil resistance long-term is tricky. I personally am of the opinion that every token competes to be the gas or payments token for as many crypto-native activities as possible and hence on a long time horizon every chain looks more like a general purpose network. But maybe that is wrong.

Celestia is very long decentralized DA demand. Its ability to provide it at genesis is strong, but its ability to provide it long-term will fluctuate with stakers who are tied solely to the revenue of rollups paying for DA. Again, inflation can make nominal security decrease, meaning Celestia needs lots of DA demand and/or to find other uses for its token to amortize inflation. And even with high DA demand, it likely needs other uses for the token or a burn of some kind.

Celestia, in lieu of what’s been called a sustainability problem, has a few ways of making its token a gas token to get closer to functional escape velocity. Today’s ideas include:

- A sovereign ZK rollup: this is far away and hence won’t be ready at launch.

- Routes to enshrining a settlement layer in Celestia: As Alex notes, execution sharding and smart contracts have drawbacks, including potential loss of credible neutrality.

- Using IBC, build a rollup which uses the L1 token for gas. Without restaking, the L2 sequencer yields would compete with yields on the base layer (fees + inflation).

While I’m personally in favor of using Interchain Security or some other form of restaking, all these approaches have some merit and it’s likely others exist as well. What matters for Celestia is that the token can function as a gas token and reap the network effects that this generates instead of becoming the Chainlink of data availability. An important consideration for any implementation will be what kind of value is created and who can manipulate that value?

Final thoughts

Credible neutrality is about creating mechanisms that don’t discriminate for or against things. Celestia’s DA would arguably be neutral to any rollup on top of it, including whose gas token is the L1 token. Nothing about this design suggests the base layer is really favoring that rollup above others in my opinion. And even if it does, it does so only mildly. More importantly for Celestia, without greater utility and other apps to pay for, the protocol may be unsustainable.

While modularity in software unlocks optimizations, modular economics is a bad idea. It reduces tokens to a few purposes, hampering the liquidity, dimensionality, and ubiquity that transforms a commodity, even a digital one, into something more. Every network needs to grapple with this, but it seems especially pertinent as Celestia works towards being a credibly neutral DA layer at scale.

Thanks to Karim and Ansem for edits and insights. Follow me on Twitter for more @MiladyEV.