Introduction

The narrative for modular blockchains is starting to gain usage to tout the superiority of next-generation blockchain infrastructure. Since Celestia positions itself as modular, and there is no concrete definition of a modular blockchain or its monolithic counterpart, it makes sense that the concept should be defined in a way that allows for appropriate analysis and distinctions to be made.

What is a modular blockchain?

A modular blockchain is a blockchain that outsources at least one of three components to an external independent chain while also conceding its ability to temporarily handle that component/s – the three components being execution, consensus, and data availability. Alternatively, monolithic blockchains are blockchains that handle all three components of the modular stack.

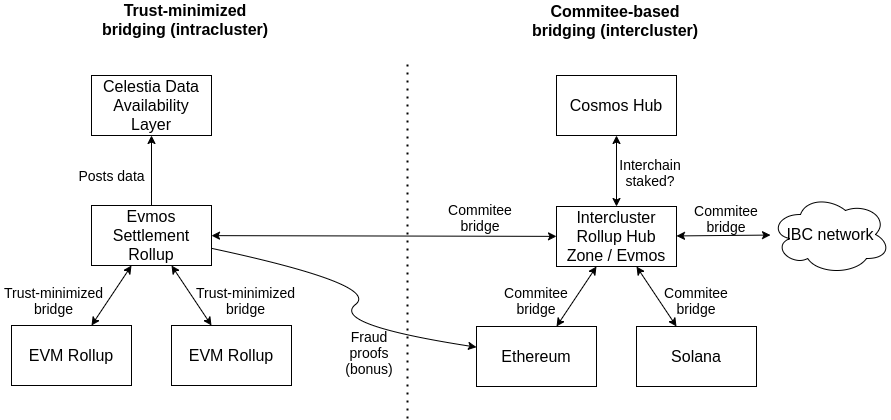

Rollups are modular because they only handle execution, outsourcing both consensus and data availability to Ethereum, for example, while conceding the temporary ability to handle those components themselves. Data availability layers, like Celestia, and settlement layers that only provide execution and consensus are also modular because they don’t handle all three components themselves.

Modularity implies flexibility. Therefore, modular chains can outsource components to separate independent chains or handle them locally – can’t handle more than two out of three components, otherwise it implies monolithic limitations. Flexibility also allows modular chains to be created, exchanged, or replaced independently within a modular stack - a core element of the modular design principle.

The modular spectrum

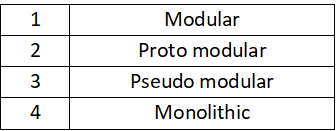

Since modular blockchains vary by architecture and design, it is necessary to define further terms to encompass this spectrum that doesn’t fit the strict definition of “modular” or “monolithic” as given above.

Proto modular will refer to any monolithic blockchain that outsources at least one component of the stack to another modular blockchain. For example, Ethereum utilizes rollups for execution while also retaining the ability to handle that component itself - under this definition, Ethereum would be proto modular. However, a monolithic blockchain that outsources a component of the stack to another monolithic blockchain will remain monolithic. Essentially, a proto modular blockchain increases its capacity for resource usage through an independent modular blockchain.

Pseudo modular will refer to monolithic blockchains that don’t outsource any components to modular blockchains but do have a design that splits the single network into multiple parts. This would encompass blockchains that have shards or sub-networks, like Polkadot and Avalanche. Essentially, a pseudo modular blockchain increases its capacity for resource usage through the utilization of other monolithic chains that are bound and dependent on the single network.

Degree of modularity

Conclusion

The definitions provided attempt to give clarity on the distinctions first between modular and monolithic, then between the varying degrees of modular. As modular blockchains progress and their architectures change over time, it may be necessary to update and expand the list of terms used to define such blockchains.